How is Your Income Protected?

Long Term Disability (LTD) picks up where Short Term Disability (STD) leaves off. Once STD benefits expire (generally after 3 to 6 months of coverage), LTD benefits kick in — usually paying 50% to 65% of salary, and generally covering the length of the disability up to social security retirement age.

LTD offers the same tax effect benefits as STD associated with premium contribution. The benefit can be paid tax free if the employee pays for the policy premium AND the policy premium is paid with after tax dollars. If either the employer pays for the policy premium, or if the policy is paid with pretax dollars, the LTD benefits will be taxable to the employee.

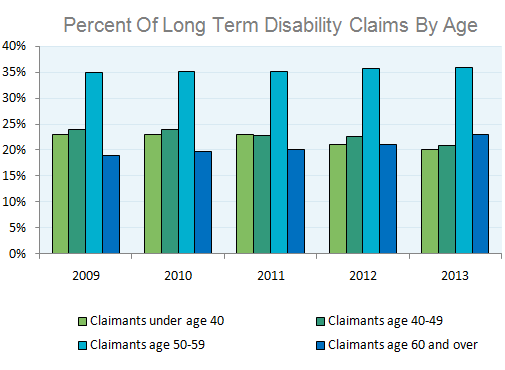

Many people associate disability with being older, but that is not the case. Per the chart below, you have a higher probability becoming disabled under the age of 40 than over the age of 60.

Not all LTD polices are created equal

We offer the Cadillac of LTD plans, which includes an own occupation definition of disability. Why is that important? Because you don't want to be forced to flip burgers if you're not totally disabled. Shocked? Don't be. Many polices have a two year own occupation limitation — which means after two years your disability benefit could end if you are able to work ANY job. Do you smell the fries yet?

Another benefit of our plan is that you can convert the policy, up to the amount allowed by contract, and take it with you if you leave your current employment. Important if your medical laundry list is getting longer.