Unlike the past, when it was not unusual to receive some sort of company pension, today most Americans are in charge of planning their own retirement destiny. But by enrolling in a "Defined Contribution" retirement plan, such as a 401(k), Americans have a powerful savings tool that comes with fantastic tax breaks.

Retirement Plan Types

The name "Defined Contribution" comes from the fact that you put your own money into the plan (your employer may agree to also put money into the plan — known as a "match"). In most cases you are responsible for deciding (or "defining") how much to contribute from your pay and the direction of the investments.

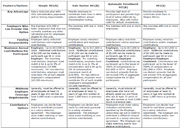

While the Traditional 401(k) is the most common, there are three other 401(k) plan types: Safe Harbor 401(k), Simple 401(k), and Automatic Enrollment 401(k) plans.

Two other examples of "Defined Contribution" plans are the Profit Sharing Plan and the Money Purchase Plan. With a Profit Sharing Plan your employer may contribute to the plan, based on profits or other factors. Money Purchase Plans are similar except the employer's contribution is based on a set amount specified in the plan, regardless of profits.

Qualified vs. Non Qualified

To explain this as simply as possible, a "Defined Contribution Plan" is a type of "Qualified Retirement Plan," which means it is designed to offer tax advantages. To be designated as a qualified plan it must meet several IRS criteria including nondiscrimination, disclosure, and participation.

"Non Qualified Plans" offered by employers are not eligible for tax advantages, and thus are always funded with after-tax dollars. Funding comes directly from the employee's earnings in the form of Salary Reduction Arrangements, Bonus Deferral Plans, Excess Benefit Plans, or Supplemental Executive Retirement Plans. Plans can be arranged with employer contributions to incent top performers.

Traditional vs. Roth 401(k) Contributions

The fundamental difference between Traditional 401(k) contributions and Roth 401(k) contributions is that Traditional contributions are pre-tax dollars, while Roth contributions are after-tax dollars.

With Traditional (pre-tax) contributions, when accumulated contributions and investment earnings are withdrawn in retirement, taxes at rates applicable at that point in time must be paid. With Roth (after-tax) contributions, since taxes were paid in the year of the contribution, withdrawal of accumulated contributions and investment earnings at retirement are tax free (in most cases, exceptions do apply).

| Roth 401(k) | Traditional 401(k) | |

|---|---|---|

| Gross Pay | $50,000 | $50,000 |

| - Pretax Deferral | $0 | $5,000 |

| Taxable Gross Pay | $50,000 | $45,000 |

| - Social Security | $3,825 | $3,825 |

| - Federal Tax | $7,895 | $6,645 |

| - Roth 401(k) Contribution | $5,000 | $0 |

| Net Pay | $33,280 | $34,530 |

| Deduction From Pay | $5,000 | $3,750 |

| + Tax Savings | $0 | $1250 |

| = Total Annual Contribution | $5,000 | $5,000 |

| Difference | $0 | $1,250 |

There are two main reasons to consider making Roth 401(k) contributions. The first reason is you believe your marginal income tax rate will be higher in retirement than it is today. This could happen either from the government raising tax rates or your actual retirement income will put you into a higher bracket.

The second main reason you may choose Roth 401(k) contributions is because they can be rolled into a Roth IRA, which does not require minimum distributions at age 70½, as the Traditional 401(k) or Traditional IRA requires. This can come in handy if you plan on working into your 70s, or if you plan on living off just the interest and dividends and passing along the principal to your heirs.

Of course, having a trophy spouse who will continue working after you retire is also a consideration.