Start Early

When should you start saving for retirement? Well if you haven't already begun, start saving today! Why? One word — compounding. Compounding allows your contributions to generate earnings, and those earnings will generate their own earnings. It's like a snowball rolling downhill — accumulating, accumulating, accumulating.

This powerful savings phenomenon is demonstrated in the chart below where four participants save $5,000 each year for ten years (total of $50K). As you will see, the participant who saved between the ages of 25-34 has ten times more at retirement than the participant that saved between the ages of 55-64.

* Assumes investment of $5000 a year for 10 years only

* Assumes investment earned 8% a year after all taxes, dividends, and distributions were reinvested

Tax Advantages

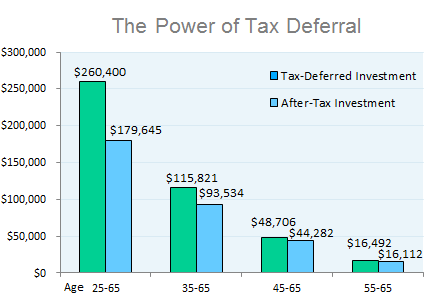

Let's make this painful subject of tax interesting. The Traditional 401(k) (and other types of defined contribution plans) offers one of the most significant tax shelters available to American citizens. This shelter known as tax deferral is best described as postponing tax on your contributions and investment earnings until retirement. By postponing these taxes, it allows the excess money to compound over long periods of time. The chart below compares the same amount invested in a tax-deferred investment vs. an after-tax investment — the difference in return can be staggering:

The chart above assumes investing $100 monthly in a tax-deferred investment account earning an 8% annual return beginning at age 25 would yield $260,400 by age 65, after taxes, assuming that the earnings portion of the accumulated investment was taxed at 30% at retirement. In contrast, a comparable investment in a fully taxable account would amount to just $179,645, assuming a 30% tax rate.

Another benefit to contributing with pretax dollars is the "feel" factor. The chart below compares what your take home pay would be if you contributed either $0 or $100 to your Traditional 401(k).

| Monthly Pay | Monthly Contribution | Taxable Pay | Taxes | Take-Home Pay |

|---|---|---|---|---|

| $2,500 | $0 | $2,500 | $700 | $1,800 |

| $2,500 | $100 | $2,400 | $672 | $1,728 |

| 1. Contribution = $100 2. Out-of-Pocket Difference = $72 3. Tax Reduction = $28 |

||||

As you can see, that $100 actually lowered your taxable income, which resulted in your take home pay being $72 less, not $100. This is the "feel" factor kicking in. Your $100 contribution only feels like $72 — and that $28 is instant tax savings straight into your retirement account.

How much should I invest?

The obvious but honest answer is "as much as you can." Most financial planners would probably advise you to get as close as possible to hitting the current year IRS limits. If you are not able to invest that much at this time, many financial planners would recommend that you begin saving 10-15% of your income, beginning in your 20's. See the chart below as a general guidance on the amount you should be saving if you have yet to start.

| Age when saving starts | % of salary to save each year |

|---|---|

| 20-29 | 10%-15% |

| 30-39 | 15%-25% |

| 40-45 | 25%-35% |

How much will I need to retire?

That question depends on many factors the crystal ball probably has yet to divulge. Will you have a mortgage? Will you want to travel in retirement? What do you think is your life expectancy? These are the types of questions that can only be answered by you — and many of those questions will change from year to year.

A financial planner will probably tell you, as a general rule, you will need around 80% of your pre-retirement income to live comfortably. That percentage can go up and down depending on debt, health, hobbies, and other factors. The best approach is to make realistic estimates of the day to day expenses and the costs associated with your ideal lifestyle in retirement. When going through this exercise, don't forget to add in expected Social Security income. The link below will send you to the Social Security Administration Benefits Estimator, which will give a general estimate of expected Social Security income based on salary.