A Safety Net

Having the ability (if your plan allows) to take out a loan against your 401(k) assets can be a safety net for dire or last resort circumstances. But there are several things to consider prior to borrowing against your 401(k). Let's review a few of these before we go into the rules of taking a loan:

1. Lost Investment Growth. Not only is the borrowed money missing out on potential growth, so is each future contribution that you may not be not making. The low interest rate for the loan that you are required to pay back into your account can be minuscule relative to the market appreciation you are missing. For example, assuming you are 30 years from retirement and take out a $50K loan that will require 4 years to payback — your nest egg will potentially be reduced by over $300K (assuming historical returns at retirement). A perfect example of how to sabotage the miracle of compounding.

2. The loan is tied to your employment. If you leave or lose your job the loan automatically becomes due. If you can't pay it back within 90 days, the loan is seen as an early withdrawal with a 10% penalty being assessed, unless you are over the age of 59½ — further eating away at your nest egg. Also, you will be required to report the amount as a taxable income on your next tax return (which could put you into a higher tax bracket).

2. The loan is tied to your employment. If you leave or lose your job the loan automatically becomes due. If you can't pay it back within 90 days, the loan is seen as an early withdrawal with a 10% penalty being assessed, unless you are over the age of 59½ — further eating away at your nest egg. Also, you will be required to report the amount as a taxable income on your next tax return (which could put you into a higher tax bracket).

3. Negative Tax Impact. When you make contributions into a traditional 401(k), the contributions are pre-tax. When you repay the loan it is with after-tax dollars. When you retire, you pay taxes again on monies you withdraw. Thus, the theory is that you are facing double taxation scenario. On top of that, interest that you pay on the loan is not tax deductible (unlike a home equity loan), regardless if it was used to buy a primary residence.

Rules of taking out a 401(k) loan are as follows:

The maximum you can currently borrow is 50% of the total vested balance of all accounts you own (can be different employers), less any current outstanding loans. The total loans outstanding cannot exceed $50,000.

There is a 12 month "look back" period, which means you can borrow up to 50% of your total vested balance of all accounts you owned for the last 12 months, reduced by the highest outstanding balance over this look back period. For example, you currently have no loans outstanding, and your account is worth $100,000 today, you could borrow $50,000 — however, if you had a $30,000 loan in the last 12 months, then you are only able to borrow $20,000 ($50,000 max available loan minus $30,000 loan outstanding).

Legally, you are required to be charged interest on the loan, and this interest is paid back into your account — by you. Sounds strange, but this is the "penalty" charge for taking the loan and being out of the market.

You have 5 years to pay the loan back, unless it is for purchase of primary residence.

Because loan restrictions are plan specific, please see your HR representative before completing an application. Please note loan rules are subject to change per IRS regulations.

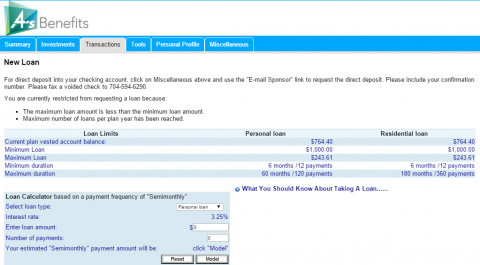

Loan Modeling

Loan modeling allows you to enter sample loan requests to illustrate what the approximate loan payment amount would be in the event that a new loan is requested. This page is for illustration purposes only.

This section assumes you have logged into your member retirement savings account.

Definitions:

Reset — This option will clear the entries prior to the submission

of a request.

Model — This option will calculate the estimated loan payment based on the loan amount and number of payments entered.

Submit — This option will allow you to submit an online loan if your plan has this feature.