Understanding Your Investment Options

The ability for you to maintain control over the direction of your investments is extremely important. For that reason, we have created a retirement plan that encompasses almost every level of risk, and which enables you to change your asset mix as your risk tolerance or age changes.

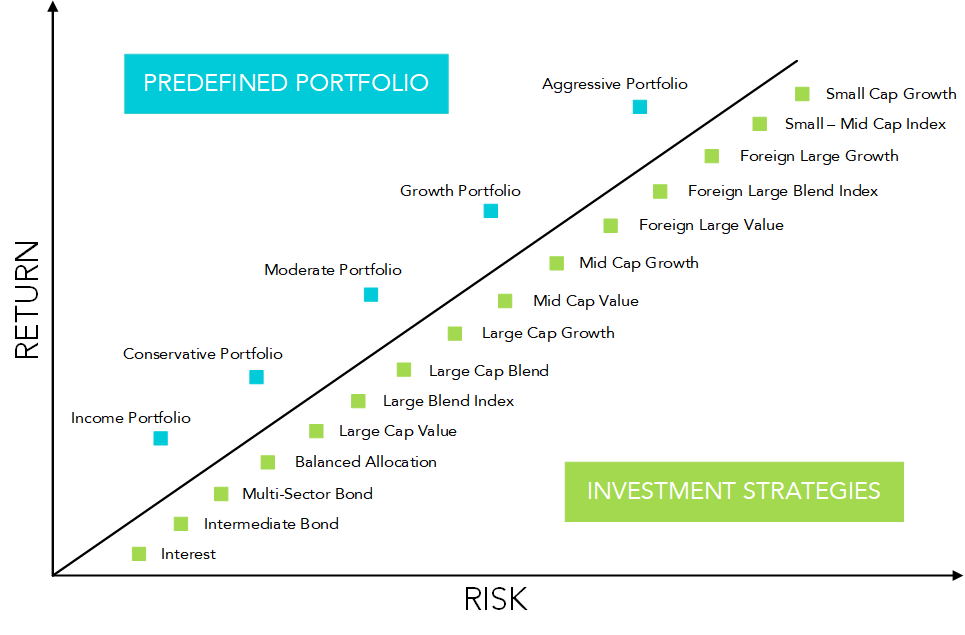

The chart below depicts the categories of our funds in a simplified Risk vs. Return model.

If you don’t fancy yourself a financial expert, consider that most financial planners would strongly suggest investing in a predefined portfolio with a specific asset mix that matches your current risk tolerance (not to be confused with Target Date Funds — please see the White Paper on Target Funds at the bottom of this page).

Our retirement plan offers five such predefined portfolios, all created by our advisors at CAPTRUST Financial Advisors. Each portfolio is comprised of a mix of stock funds (equities) or a combination of stock (equity) and bond (fixed income) funds, and is rebalanced once a year to ensure the asset mix stays true to its intended risk tolerance. CAPTRUST has provided a suggested age range for each portfolio along with a custom questionnaire to determine correct fit based on personal risk profile. These portfolios are as “turn-key” as it gets.

Your personal investment guru is available to you 24/7 through AdvicePlus. For an example, see the AdvicePlus PDF at the bottom of this page.

Portfolio Types

Income Portfolio

- 80% Fixed Income

- 20% Equities

This allocation may be appropriate for large investors who:

- Cannot tolerate large swings in value

- Want to retain some protection against inflation without assuming a large percentage of stocks in their portfolio

Conservative Portfolio

- 60% Fixed Income

- 40% Equities

This allocation may be appropriate for investors who:

- Prefer income-generating investments, but desire some long-term growth

- Strive for more protection against inflation and can tolerate some periodic declines in portfolio value

Moderate Portfolio

- 40% Fixed Income

- 60% Equities

This allocation may be appropriate for investors who:

- Are growth oriented and desire to reduce volatility through diversification

- Are willing to accept moderate levels of portfolio risk and recognize that increased allocations to stocks can lead to longer periods of portfolio declines

Growth Portfolio

- 20% Fixed Income

- 80% Equities

This allocation may be appropriate for investors who:

- Primarily seek a stock-based portfolio yet desire some diversification through bonds

- Are able to tolerate potential negative periods in the short term in an attempt to achieve greater long-term growth

Aggressive Portfolio

- 100% Equities

This allocation may be appropriate for investors who:

- Have high return expectations for their portfolios

- Are able to tolerate significant negative returns in portfolio value in an attempt to achieve maximum long-term growth

Our Fund Families

Curious about the funds in our plan? We can tell you that they are consistently top performers in their categories, and are represented from the following fund families:

|

|

|

|

|

|

|

|

|

Impressive, we know.